While most employees interact honestly with payroll systems, some engage in misconduct that directly impacts your payroll operations and business finances. From timesheet fraud to payroll data breaches, these issues require swift action while maintaining compliance with New Zealand employment law. Here’s how to handle these challenging situations.

Common Payroll-Related Misconduct

Timesheet Fraud: Falsifying hours worked, having colleagues clock in/out on their behalf, or inflating overtime hours.

Leave Abuse: Manipulating sick leave, falsifying medical certificates, or misrepresenting leave entitlements.

Payroll Data Breaches: Accessing colleagues’ pay information without authorization, sharing confidential payroll data, or breaching privacy obligations.

Payment Disputes: Repeatedly and unreasonably disputing correct pay calculations, wasting administrative time with unfounded complaints.

System Manipulation: Attempting to alter payroll records, holiday balances, or personal banking details inappropriately.

Your Legal Framework

When dealing with payroll misconduct, you’re operating under several pieces of legislation:

- Employment Relations Act 2000: Requires good faith and fair process

- Wages Protection Act 1983: Limits deductions from wages

- Privacy Act 2020: Governs how you handle payroll data and investigations

- Holidays Act 2003: Defines entitlements that employees may be abusing

Immediate Steps When Misconduct is Suspected

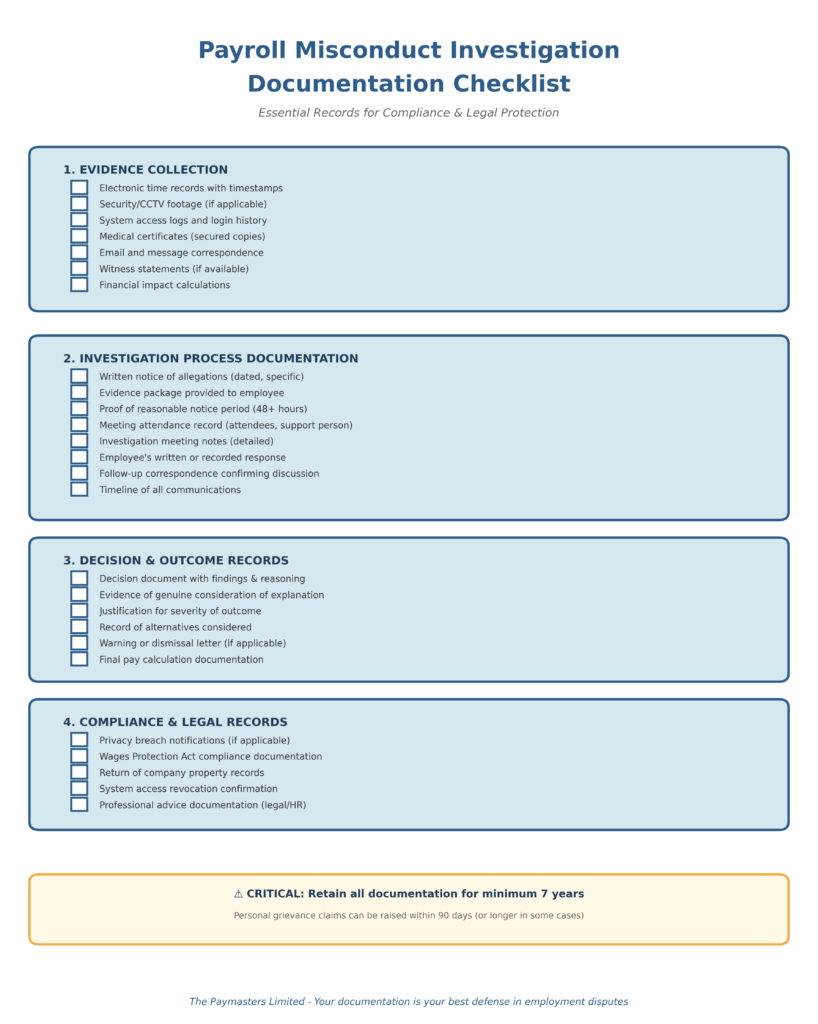

1. Secure the Evidence Before alerting the employee, gather and preserve evidence. This might include:

- Electronic time records with timestamps

- Security footage of clock-in/out times

- System access logs showing unauthorized data access

- Bank records showing incorrect payments

- Medical certificates (verify with provider if fraud suspected)

- Email or message trails

2. Conduct a Preliminary Investigation Determine whether there’s sufficient evidence to proceed. Consider:

- Is the evidence conclusive or circumstantial?

- Could there be an innocent explanation?

- How serious is the misconduct?

- What’s the financial impact?

3. Suspend if Necessary For serious cases (significant fraud, data breaches), you may need to suspend the employee on full pay while investigating. This is particularly important if they have ongoing access to payroll systems or financial data. Document the suspension clearly, stating it’s not disciplinary but to allow fair investigation.

The Investigation Process

Fair Process Requirements

- Advise the employee in writing of the allegations with specific details

- Provide copies of relevant evidence

- Give reasonable time to prepare a response (typically 48 hours minimum)

- Allow them to bring a support person to any meeting

- Listen with an open mind to their explanation

- Keep the investigation confidential to protect all parties

Payroll-Specific Investigation Tips

- Involve your payroll provider or accountant in analyzing complex data

- Check for patterns over time, not just isolated incidents

- Review system permissions and access controls

- Verify whether others might be involved

- Calculate the financial loss accurately

Addressing Timesheet Fraud

Timesheet fraud is one of the most common payroll-related misconduct issues. If you discover an employee has been falsifying hours:

First Instance/Minor Discrepancy: May warrant a written warning if the employee acknowledges the error and there’s no pattern of behavior.

Serious or Repeated Fraud: Could justify dismissal, especially if:

- The fraud is deliberate and substantial

- It represents theft from the business

- Trust is irretrievably damaged

- The employee denies obvious evidence

Recovering Overpayments: Under the Wages Protection Act 1983, you can only deduct overpayments from wages if the employee agrees in writing or you obtain a court order. You cannot simply deduct the money, even if the employee obtained it fraudulently. Document the overpayment clearly and seek legal advice before proceeding with recovery.

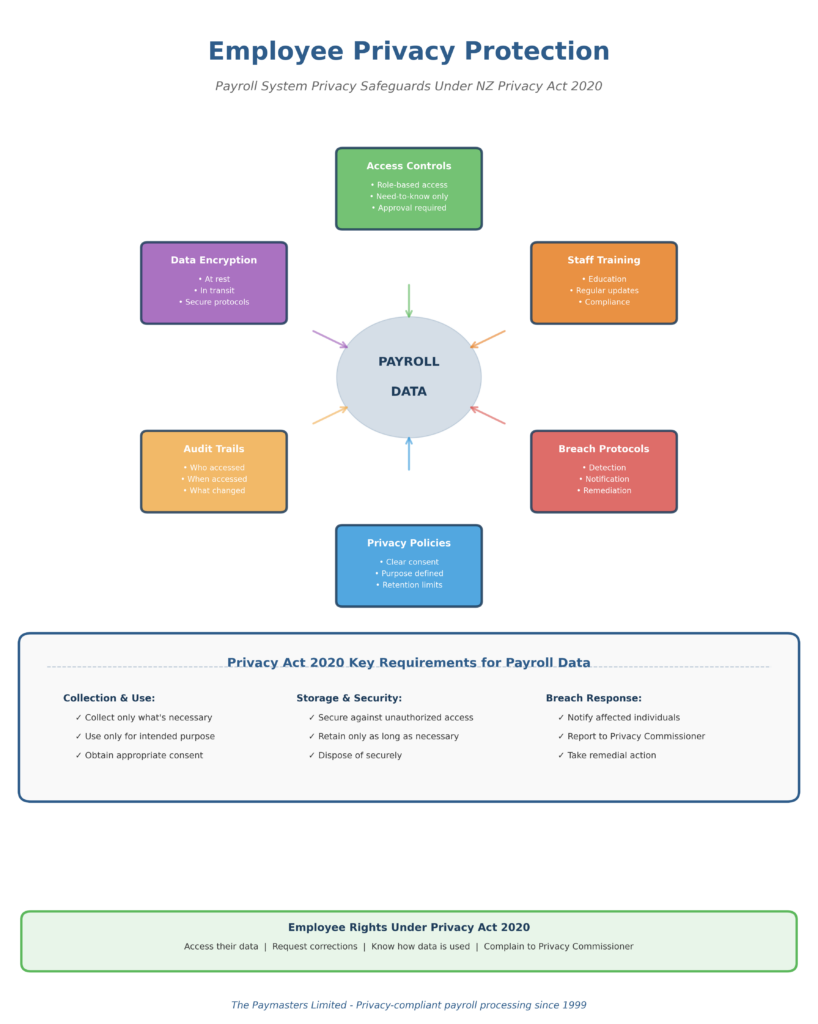

Handling Payroll Privacy Breaches

If an employee accesses colleagues’ pay information without authorization or shares payroll data inappropriately, this is serious misconduct. It breaches:

- Their employment obligations

- Privacy Act 2020 requirements

- Your confidentiality policies

Immediate Actions:

- Revoke unnecessary system access immediately

- Change passwords and review access permissions

- Notify affected employees if their privacy was breached (Privacy Act requirement)

- Consider whether you need to notify the Privacy Commissioner (required for serious breaches)

Disciplinary Response: Payroll confidentiality breaches typically justify serious consequences, including dismissal, as they fundamentally breach trust and potentially expose you to Privacy Act violations.

Dealing with Leave Fraud

When an employee falsifies sick leave or medical certificates:

Medical Certificate Verification: You can contact the medical provider to verify a certificate’s authenticity (but not to discuss the employee’s medical condition). Under the Privacy Act 2020, verification of document authenticity is permitted.

Sick Leave Patterns: Monitor for suspicious patterns (sick leave on Mondays/Fridays, before/after holidays, during busy periods). Document these patterns as they may indicate abuse.

Consequences: Falsifying medical certificates is serious misconduct that can justify dismissal, as it involves dishonesty and fraud. However, you must still follow fair process.

Managing Constant Pay Disputes

Some employees repeatedly dispute their pay, often incorrectly, creating significant administrative burden. While employees have the right to query their pay, unreasonable or vexatious complaints can be addressed:

Document Everything: Keep records of each dispute, your response, and the outcome.

Provide Education: Ensure the employee understands how their pay is calculated. Provide detailed payslips, explain leave accruals, and offer to walk through calculations.

Set Boundaries: After multiple unfounded disputes, you can advise the employee in writing that future queries must be specific, reasonable, and made in good faith.

Performance Management: If the behavior continues and impacts operations, it can become a performance/conduct issue, but this requires careful handling.

Making the Final Decision

After investigation, you might conclude that:

- No misconduct occurred: Document the finding, reinstate the employee if suspended, and consider system improvements to prevent future misunderstandings.

- Minor misconduct: Issue a written warning outlining expectations and consequences of repetition.

- Serious misconduct: Dismissal may be justified, but you must follow fair process.

Dismissal for Payroll Misconduct

Before dismissing for payroll-related misconduct, ensure:

- The evidence is clear and documented

- The employee had full opportunity to respond

- You genuinely considered their explanation

- The misconduct is serious enough to warrant dismissal

- You’ve considered alternatives (warnings, additional training, redeployment)

Document Your Decision: Provide a dismissal letter clearly stating:

- The misconduct findings

- Why the explanation wasn’t accepted

- Why dismissal is justified

- Final pay details and entitlements

- Return of company property

Final Pay Considerations

Even when dismissing for misconduct, you must pay all lawful entitlements:

- Wages for time actually worked

- Accrued but untaken annual leave (paid out at 8% of gross earnings)

- Any other contractual entitlements

You cannot withhold final pay to recover losses from fraud without agreement or a court order, regardless of how clear-cut the theft appears.

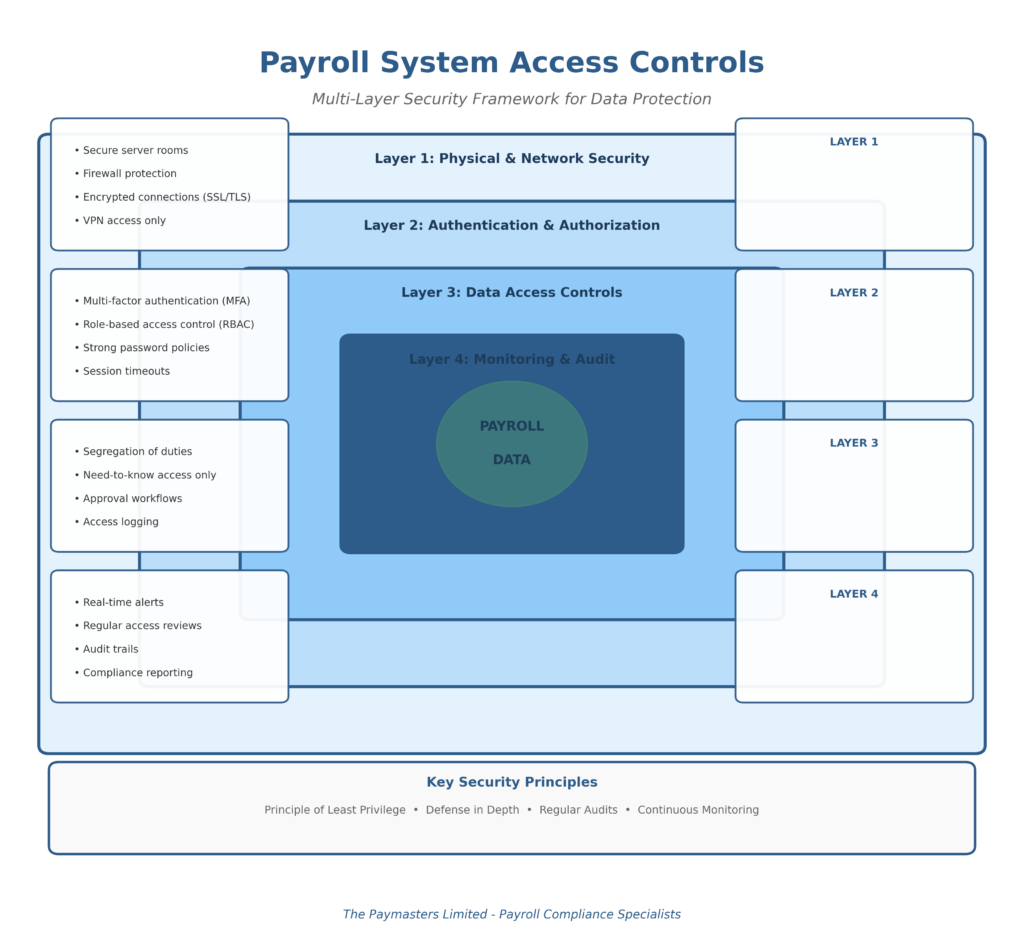

Preventing Future Issues

System Controls:

- Implement proper access controls on payroll systems

- Use biometric time clocks or photo verification for clocking

- Require manager approval for timesheets

- Regular system access audits

- Segregation of duties (different people approve, process, and review payroll)

Clear Policies:

- Written timesheet procedures

- Confidentiality agreements

- Social media and privacy policies

- Disciplinary procedures

Regular Training:

- Educate employees on payroll deadlines and processes

- Train managers to spot and address issues early

- Regular refreshers on confidentiality obligations

Frequently Asked Questions

Can I deduct overpayments from an employee’s wages in New Zealand?

No, under the Wages Protection Act 1983, you can only deduct overpayments from an employee’s wages if the employee agrees in writing or you obtain a court order. This applies even when the overpayment resulted from the employee’s fraudulent behavior, such as falsifying timesheets. You must document the overpayment clearly and seek legal advice before attempting recovery.

Is timesheet fraud grounds for dismissal in New Zealand?

Yes, serious or repeated timesheet fraud can justify dismissal in New Zealand. However, you must follow fair process, which includes conducting a proper investigation, providing the employee with specific details of the allegations, giving them opportunity to respond and bring a support person, and genuinely considering their explanation before making a final decision. The fraud must be deliberate and substantial enough to warrant dismissal.

Can I verify a medical certificate with a doctor in New Zealand?

Yes, you can contact the medical provider to verify a certificate’s authenticity under the Privacy Act 2020. However, you cannot discuss the employee’s medical condition or seek details about their illness. You can only confirm whether the certificate is genuine and was issued by that provider. If you suspect a certificate has been falsified, verification is an important step in your investigation.

Do I need to notify the Privacy Commissioner if an employee breaches payroll confidentiality?

Under the Privacy Act 2020, you must notify the Privacy Commissioner if a privacy breach is likely to cause serious harm to affected individuals. If an employee accessed or shared colleagues’ salary information, you need to assess the risk of harm. At minimum, you must notify the affected employees whose information was breached. The Privacy Commissioner provides guidance on when notification is required.

What should I do if I suspect an employee is having a colleague clock them in?

First, gather evidence such as security footage, electronic time records with timestamps, or witness statements. Then conduct a proper investigation following fair process – advise the affected employee(s) in writing of the allegations, provide evidence, and give them opportunity to respond. Both employees involved may face disciplinary action. Consider implementing biometric time clocks or photo verification systems to prevent future occurrences.

How long should I keep payroll misconduct investigation records?

You should retain all documentation related to payroll misconduct investigations for at least seven years. This includes investigation notes, evidence, meeting records, warnings, and dismissal documentation. These records may be essential if the employee brings a personal grievance claim (which they can do within 90 days of dismissal, or longer in some circumstances). Proper documentation is your best defense in any employment dispute.

Can an employee claim unfair dismissal if they falsified their timesheet?

Yes, an employee can bring a personal grievance claim for unjustified dismissal even if they engaged in misconduct. However, if you followed proper process and the misconduct was serious enough to warrant dismissal, their claim is unlikely to succeed. The key is ensuring you met both substantive justification (genuine reason for dismissal) and procedural fairness (proper investigation and opportunity to respond). Many personal grievance claims succeed not because the misconduct didn’t occur, but because the employer failed to follow fair process.

What’s the difference between suspending an employee and dismissing them?

Suspension is a temporary measure where you place the employee on paid leave while you investigate serious allegations. It’s not a disciplinary action but allows you to conduct a fair investigation, particularly when the employee has access to sensitive payroll systems or data. Suspension should be as brief as possible. Dismissal is the permanent termination of employment and should only occur after a full investigation and fair process. You cannot dismiss first and investigate later.

Get Expert Support

Payroll misconduct investigations can be complex, involving technical payroll analysis alongside employment law compliance. The costs of getting it wrong – both financial and reputational – make professional advice worthwhile. The following templates may be helpful as a guide, but we suggest you always seek Legal Advice.

The Paymasters has over 25 years of experience supporting New Zealand employers with payroll compliance, investigating payroll discrepancies, and providing documentation for employment processes. Our NZPPA-certified team can help you navigate complex payroll issues while maintaining legal compliance.

Contact us HERE!